Though I once sang their praises for their return shipping refund (which ended in November 2022), I learned the hard way not to use the PayPal platform for any foreign transactions.

You see, last month we booked several Airbnbs for our trip to Spain and Italy, and to avoid Airbnb’s conversion fees, I always book in the local currency (Euros, in this case). I felt quite smart and smug, booking in foreign currency on a card with zero foreign transaction fees. However, it was a little late in the evening, and my wallet was way over there – so I just clicked through PayPal to complete the transaction on my Chase card.

This post contains affiliate or referral links, and I may receive a small commission or credit if you click through one of these links (at no additional cost to you!). This allows me to continue sharing content without advertisements, so thank you!

It wasn’t until the next day that I noticed that my Discover card had been charged instead, and I reached out to PayPal to correct the transaction. They claimed that the preferred card on file (the Chase card) had been declined, and my Discover card was the next in line to be charged. This, as it turns out, was false – though my Chase card was set as my preferred card for everything (in bright blue letters!), my Discover card was somehow marked as the preferred card when booking through Airbnb. Annoying and confusing, right?

And that’s not even the point of this post.

What I learned as I went through the process of trying to refund my Discover card and assign the charge to my Chase card to ensure I net the best rewards for my purchase (side note: PayPal wouldn’t reverse the charge, but Airbnb kindly and easily made it happen), is that when you pay for a transaction in a foreign currency through PayPal, your credit card isn’t the one calling the shots on the conversion rate – it’s PayPal. And they happen to take a nice little cut for themselves.

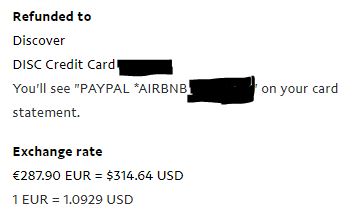

Below is what I initially paid for the reservation on my Discover card, via PayPal:

And here is what PayPal refunded me on my Discover card the following day when I switched payment over to my Chase card:

Wait – what happened to the remaining $16.10?

When I posed that question to PayPal, I received many different responses, ranging from, “On our review of your account we notice, there was just the difference in refund occurred because it changes daily. We go by the exchange rate on the refund date not the original transaction date, the refund happened on September 13, was considered with the Exchange rate on that day,” to “I understand that you are concerned about a refund amount. I do hope that you are aware of the changing currency conversion rates on a daily basis,” to “There was the difference in refund amount because the conversion rate changes every minutes. I am sorry about the previous information that my colleague has provided that the conversion rate changes daily,” to “Please be informed that currency conversion takes place every now and then.”

Yikes.

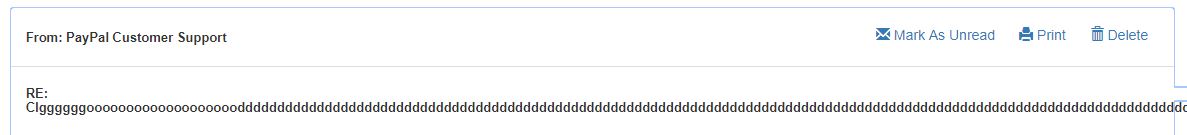

And I guess they must have gotten annoyed with all of my questions – check out this message subject line from one of their employees:

But you know how I know that’s all baloney?

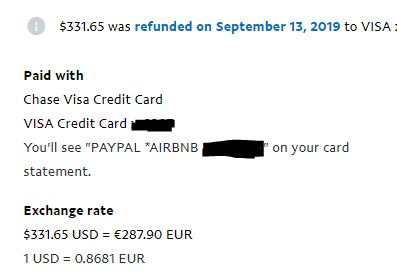

Because when Airbnb refunded me, they accidentally charged me once more for my reservation via PayPal on my Chase card (not to worry as it was immediately refunded – thanks Airbnb!). And this all occurred within the same minute:

So no, the exchange rate didn’t change as drastically as they claimed; that extra $16 went directly to PayPal as a fee, which isn’t clearly disclosed at checkout. In fact, it appears they charged me a conversion fee twice: once at booking and once at the time of refund.

And as frustrating as it was to spend, USD 16 on well, nothing, it’s even more frustrating because this isn’t the first time I’ve paid in international currency on PayPal. It’s just the first time I’ve paid attention.

Moving forward, I’ll be using my zero foreign transaction fee card directly for all international purchases, and I recommend you do the same.

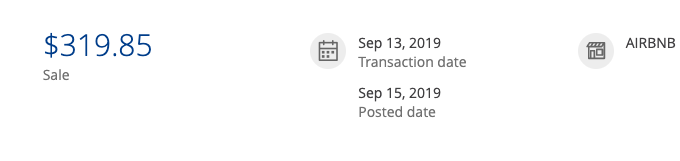

Here you can see how Chase converted the same amount (€287.90) to USD:

This amount is much closer to the rate posted on September 13.

Lesson learned!

But if you must book via PayPal (some foreign websites have issues accepting U.S. credit cards), you’ll have to adjust your preferred conversion method (and hope that the merchant is listed in your Active Payments tab in your account) to convert via your credit card rather than PayPal. Here’s how to make that change, directly from PayPal:

1. Click the Settings icon next to “Log out”.

2. Click Payments at the top.

3. Click Manage Automatic Payments.

4. Find the billing agreement you’d like to change, then click the edit icon next to your payment method.

5. Click Conversion options.

6. Select the currency conversion option you want and click Agree.

I haven’t tried it (you can tell I’m pretty salty still with PayPal), so I’m not sure if these settings can be changed immediately after purchasing from a new vendor. If you happen to make a foreign transaction with PayPal and attempt to change these settings after the fact, will you let us know in the comments below?

(2022 edit: you can now change a purchase’s currency to the local currency during checkout – it’s much easier!)

Update: So several days after I drafted this post and sent many, many messages requesting to communicate with a supervisor about this issue (I prefer to get things in writing rather than over the phone), I received a voicemail apologizing for the issue and a deposit of $16.10 in my account. Was it worth the amount of time I spent communicating with them? Not at all – but equipping myself with the tools I need to make fewer money missteps in the future is priceless.

Where to next? How about one of these:

- How to Split Travel Costs When One Person Makes More Money

- 20 Questions You Should Ask a Potential Travel Partner Before You Leave Home

- 5 Easy Ways to Save Money This Week (for your next trip!)

- What Happens When You Cancel a Non-refundable Trip?

- Dinner Party Survival Kit: 20 Travel-Themed Conversation Starters

- 5 Easy Things You Can Do Today to Save for Your Next Trip

- How We Search for Flights

- I won a trip! (Now what?)

- All Travel Guides by Destination

- All of My Real-Life Packing Lists

- All Style Reviews, Sorted by Brand

- Shop My Closet

- Exclusive Discounts + Promo Codes

What is a recent money-saving discovery you’ve made?

Thank you for sharing this and warning us! So frustrating and shady.